Severe rain and weather: If you are a Vero customer and need to claim, fill out our online claims form Claims | Vero or contact your broker.

VERO SME

INSURANCE INDEX

2021 Edition - Issue 2

Find out what SMEs

value from a broker

or adviser

Insights from the latest Vero SME Insurance Index

About the 2021 Vero SME Insurance Index

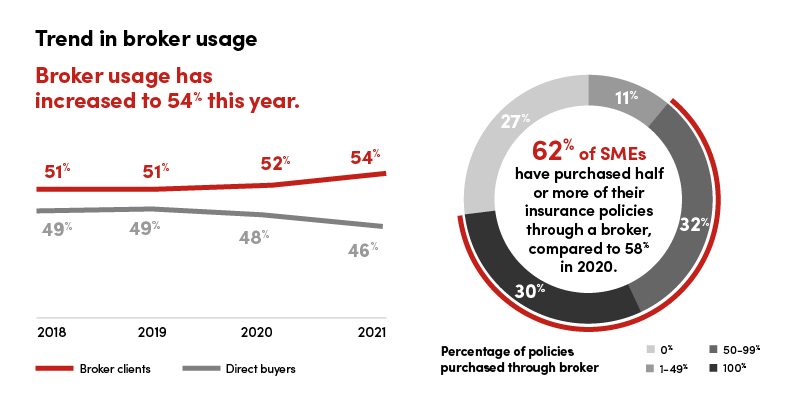

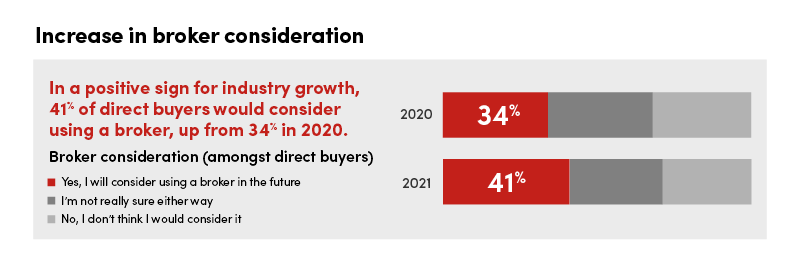

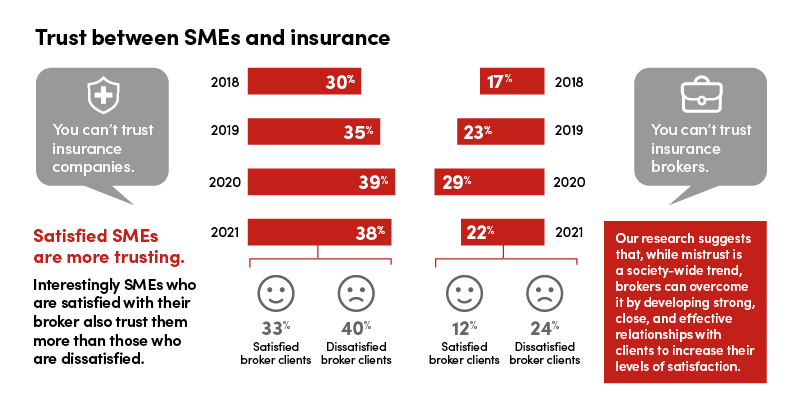

The second issue of the 2021 Vero SME Insurance Index shares insights on trends in insurance behaviour and attitudes.

Following the deep dive into claims earlier in the year, in this issue we have delved deep to understand the diversity of New Zealand small business – who they are, how they feel about insurance and how their insurance behaviour is changing and why?

The tools to help you

Our Risk Management specialists have updated the Vero Risk Profiler to include information on ways to minimise property damage caused by a natural disaster. Find this information in the specific risk section under Natural Events.

The Vero Risk Profiler provides a wealth of information on typical business risks including claims stats, guides, checklists and in-depth information on high risk activity. You can find the Risk Profiler here.

View all issues

View all the customer insights from each issue of the Vero SME Insurance Index. These insights will help build a deeper understanding of commercial insurance for SMEs in New Zealand.

Insurance policies made for SMEs

Keep reading

Vero Voice Blog

Protecting your business from interruption

One of the big concerns for many business owners is what would happen if your premises were damaged severely and you weren’t able to trade for several months, or even years. One way to give yourself peace of mind is to have Business Interruption insurance.

Read blog